Sen. Cornyn advocates for extension of Trump tax cuts in Mission

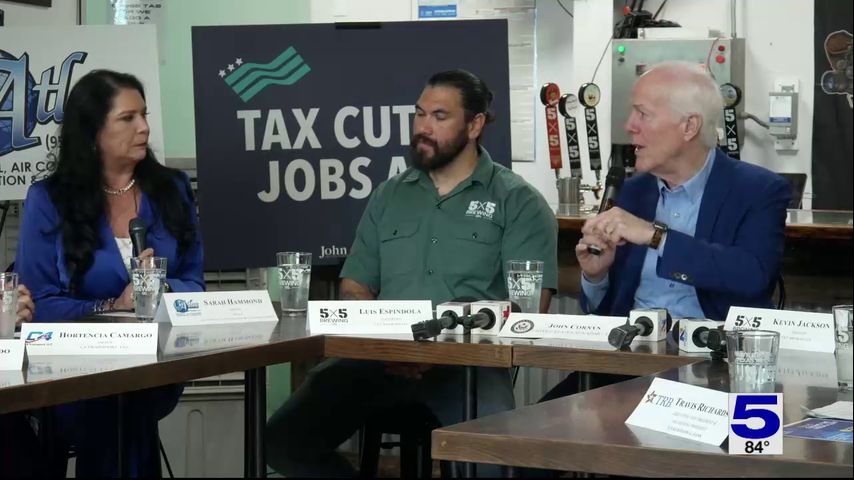

At the veteran owned 5x5 Brewing Co. in Mission, a community can be found alongside the variety of beer.

Co-owner Luis Espindola said they've been able to expand their businesses and buy equipment with the savings that tricked down from the 2017 Tax Cut and Jobs Act.

The act changed the internal revenue code to reduce tax rates and deductions for business, but it added to the federal government's budget deficit. It was signed into law by President Donald Trump in 2016, and is set to expire at the end of 2025.

Now, several lawmakers are pushing for its extension. Among them is Sen. John Cornyn, who visited the brewery Thursday to discuss extending the act.

“It produced savings that small businesses can use to build their business,” Cornyn said during a press conference following a roundtable discussion with other small business owners.

Critics of the extension said the act mostly benefits large corporations and the wealthy. If Congress extends the act, estimates show it could increase deficits by nearly $4 trillion in the next 10 years.

“One of the things I think we need to do is deal with the spending problem that the federal government has,” Cornyn said. “The reason we have the $37 trillion debt is not that we don't tax people enough, but that we spend too much money."

STC economic professor Teo Sepulveda said if businesses take advantage of the bill's savings to produce enough product, "any deficit that the lower taxes can create will be completely covered by the real production of goods and services we get."

Sepulveda said the looming tariffs can affect business' productions.

“Because of the uncertainty, many companies are just postponing pretty much everything they would appreciate — the lower taxes and paperwork — but regardless it doesn't have the same incentive structure as before,” Sepulveda said.

Watch the video above for the full story.